Unlocking the Potential: Real Estate Crowdfunding 101

Real estate crowdfunding has been gaining popularity in recent years as a way for investors to pool their funds together and invest in real estate projects. This innovative form of investing allows individuals to access the real estate market with lower capital requirements, diversify their portfolios, and potentially earn higher returns compared to traditional real estate investments.

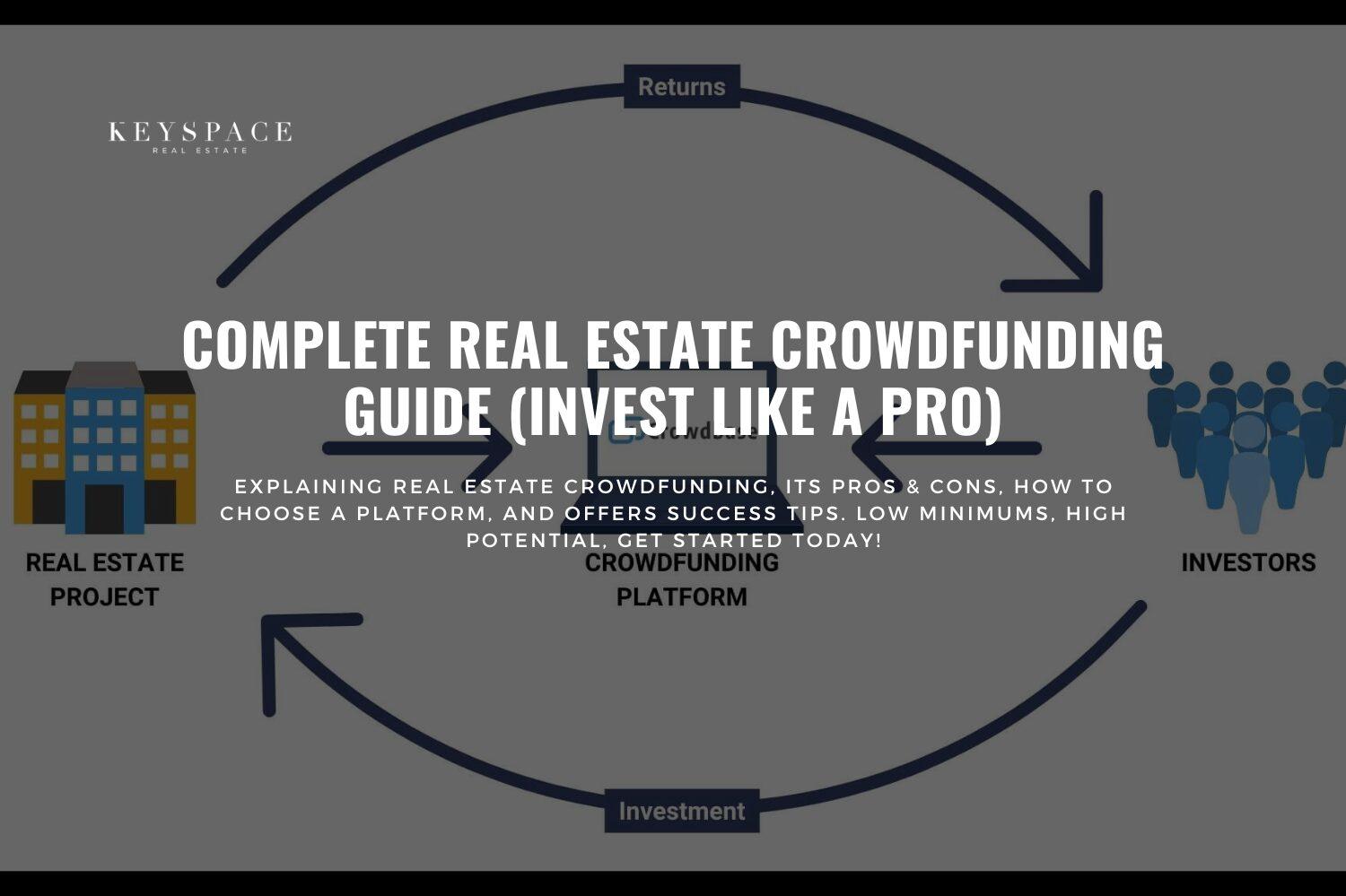

So, what exactly is real estate crowdfunding and how does it work? In simple terms, real estate crowdfunding is a method of raising capital for real estate projects through online platforms that connect investors with real estate developers or sponsors. Investors can browse through various projects on these platforms, select the ones they are interested in, and invest as little as a few hundred dollars to become part-owners of the property.

One of the key benefits of real estate crowdfunding is the ability to diversify your investment portfolio without the need for a large sum of money. By investing in multiple projects across different locations and asset classes, investors can spread their risk and potentially increase their returns. Additionally, real estate crowdfunding provides access to a wide range of investment opportunities that may not be available through traditional real estate channels.

When it comes to maximizing returns through real estate crowdfunding, there are a few key strategies to keep in mind. Firstly, it is important to conduct thorough due diligence on the platform and the projects available for investment. Look for platforms with a track record of successful projects and transparent communication with investors. Additionally, carefully review the details of each project, including the location, property type, projected returns, and the experience of the development team.

Image Source: keyspacerealty.com

Another important factor to consider when investing in real estate crowdfunding is the level of diversification in your portfolio. While it can be tempting to invest a large portion of your funds in a single high-potential project, spreading your investment across multiple projects can help mitigate risk and potentially increase overall returns. By diversifying across different asset classes, locations, and risk profiles, investors can protect themselves against market fluctuations and unforeseen events.

Furthermore, it is essential to maintain a long-term perspective when investing in real estate crowdfunding. Real estate projects typically have longer investment horizons compared to other asset classes, so it is important to have patience and allow your investments to grow over time. Resist the urge to constantly monitor your investments and focus on the bigger picture of building a diversified and sustainable portfolio.

In conclusion, real estate crowdfunding presents a unique opportunity for investors to access the real estate market with lower capital requirements, diversify their portfolios, and potentially earn higher returns. By conducting thorough due diligence, diversifying your portfolio, and maintaining a long-term perspective, investors can maximize their returns and achieve success in the world of real estate crowdfunding. So, unlock the potential of real estate crowdfunding today and start your journey towards investment success!

Skyrocket Your Savings: Tips for Investment Triumph

Real estate crowdfunding has become a popular way for investors to diversify their portfolios and potentially earn high returns. With the rise of online platforms that connect investors with real estate developers, it has never been easier to get involved in this lucrative market. However, success in real estate crowdfunding requires careful planning and strategic decision-making. In this article, we will explore some tips to help you maximize your returns and achieve investment triumph.

1. Do Your Research

Before diving into real estate crowdfunding, it is important to thoroughly research the market and understand the potential risks and rewards. Take the time to educate yourself about different types of real estate investments, such as residential, commercial, and industrial properties. Consider factors such as location, market trends, and the track record of developers before making any investment decisions.

2. Set Clear Goals

It is essential to have a clear investment strategy and set realistic goals for your real estate crowdfunding endeavors. Determine your risk tolerance, desired return on investment, and investment timeline. Having a clear plan in place will help you make informed decisions and stay focused on your long-term objectives.

3. Diversify Your Portfolio

Diversification is key to reducing risk and maximizing returns in real estate crowdfunding. Spread your investments across different types of properties and geographic locations to minimize the impact of market fluctuations. By diversifying your portfolio, you can increase your chances of success and protect your investments from unforeseen events.

4. Invest in Quality Projects

When selecting projects to invest in, focus on quality over quantity. Look for reputable developers with a proven track record of success and a solid reputation in the industry. Consider factors such as the developer’s experience, financial stability, and the potential for property appreciation. Investing in high-quality projects will increase your chances of earning attractive returns and minimize the risk of losses.

5. Monitor Your Investments

Once you have made your investments, it is important to regularly monitor their performance and make adjustments as needed. Keep track of market trends, property values, and the financial health of your investments. Stay informed about any changes in the market that could impact your investments and be prepared to take action to protect your portfolio.

6. Reinvest Your Returns

To maximize your returns in real estate crowdfunding, consider reinvesting your profits into new projects. Reinvesting your returns can help you grow your portfolio and earn compounding returns over time. By continuously reinvesting your profits, you can accelerate the growth of your investments and achieve investment triumph.

In conclusion, real estate crowdfunding offers investors the opportunity to earn attractive returns and diversify their portfolios. By following these tips and strategies, you can maximize your returns and achieve investment triumph in the competitive world of real estate crowdfunding. Remember to do your research, set clear goals, diversify your portfolio, invest in quality projects, monitor your investments, and reinvest your returns for long-term success. With careful planning and strategic decision-making, you can skyrocket your savings and achieve your investment goals in real estate crowdfunding.

How to Leverage Real Estate Crowdfunding for Investment Success