Don’t Let Inflation Ruin Your Investments!

In today’s fast-paced world, it’s essential to safeguard your investments against the effects of inflation. With prices constantly on the rise, it’s easy for your hard-earned money to lose its value over time. However, there are several strategies you can implement to protect your investments and ensure that they continue to grow despite the challenges of inflation.

One of the most important things you can do to shield your investments from the effects of inflation is to diversify your portfolio. By spreading your investments across different asset classes, you can reduce the risk of losing money when prices go up. This way, if one sector of the economy is hit hard by inflation, your other investments can help offset any losses.

Another key strategy for protecting your investments against inflation is to invest in assets that tend to perform well during periods of rising prices. For example, real estate and commodities such as gold and silver have historically been good hedges against inflation. By including these types of assets in your portfolio, you can help ensure that your investments maintain their value over time.

In addition to diversifying your portfolio and investing in inflation-resistant assets, it’s also important to regularly review and adjust your investments to keep pace with changing economic conditions. This means staying informed about current market trends and making strategic changes to your portfolio as needed. By staying proactive and monitoring your investments closely, you can position yourself to weather the effects of inflation and continue to grow your wealth.

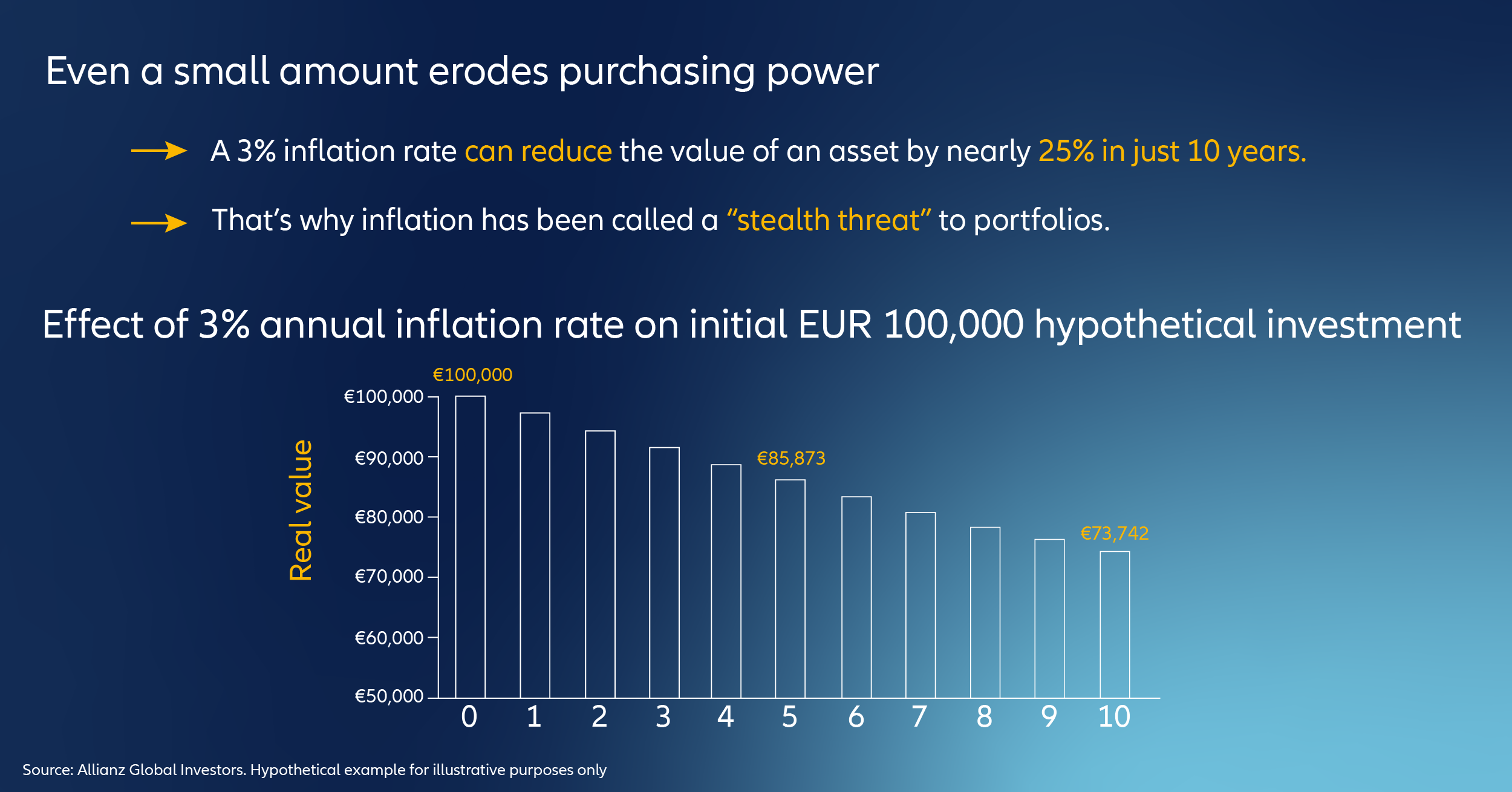

Image Source: allianz.com

Furthermore, it’s important to consider the impact of inflation on your investment returns. While inflation can erode the value of your money over time, it can also have a positive effect on certain investments. For example, companies that produce essential goods and services may be able to raise their prices in response to inflation, leading to higher profits and potentially higher returns for investors. By understanding how inflation can affect different types of investments, you can make more informed decisions about where to allocate your money.

Overall, protecting your investments against the effects of inflation requires a proactive and strategic approach. By diversifying your portfolio, investing in inflation-resistant assets, staying informed about market trends, and considering the impact of inflation on your investment returns, you can shield your investments from the negative effects of rising prices and position yourself for long-term financial success. So don’t let inflation ruin your investments – take action today to safeguard your financial future!

Shielding Your Investments: Navigating the Effects of Inflation

In a world where the economy is constantly fluctuating, it’s important to take steps to safeguard your investments from the effects of inflation. As prices rise and the value of money decreases, your portfolio can take a hit if you’re not prepared. That’s why it’s crucial to have a plan in place to protect your hard-earned money.

One strategy to safeguard your portfolio from the effects of inflation is to diversify your investments. By spreading your money across different asset classes, you can reduce the risk of losing everything if one sector takes a hit. This can help you weather the storm of inflation and ensure that your portfolio remains strong even in uncertain times.

Another strategy is to invest in assets that tend to perform well during periods of inflation. This could include commodities like gold and silver, which have historically retained their value when the value of fiat currencies decreases. Real estate is another asset class that tends to perform well during inflationary periods, as property values tend to rise along with prices.

Additionally, consider investing in Treasury Inflation-Protected Securities (TIPS), which are designed to protect investors from the effects of inflation. These government bonds adjust their principal value based on changes in the Consumer Price Index, ensuring that your investment keeps pace with inflation.

You could also consider investing in dividend-paying stocks, which can provide a steady income stream even when the value of money is decreasing. By reinvesting your dividends, you can continue to grow your portfolio even in the face of inflation.

One often-overlooked strategy for safeguarding your investments from inflation is to regularly review and adjust your portfolio. As economic conditions change, certain asset classes may become more or less valuable. By staying informed and making adjustments as needed, you can ensure that your portfolio remains resilient in the face of inflation.

Finally, don’t forget the importance of staying patient and disciplined in your investment strategy. Inflation can be a scary thing, but by sticking to your plan and not panicking when prices rise, you can ride out the storm and come out on top in the end.

In conclusion, safeguarding your investments from the effects of inflation is crucial in today’s ever-changing economy. By diversifying your portfolio, investing in inflation-resistant assets, and staying disciplined in your strategy, you can protect your hard-earned money and ensure a secure financial future. So don’t let inflation ruin your investments – take action today to shield your portfolio from its effects.

The Impact of Inflation on Your Investments and How to Protect Yourself